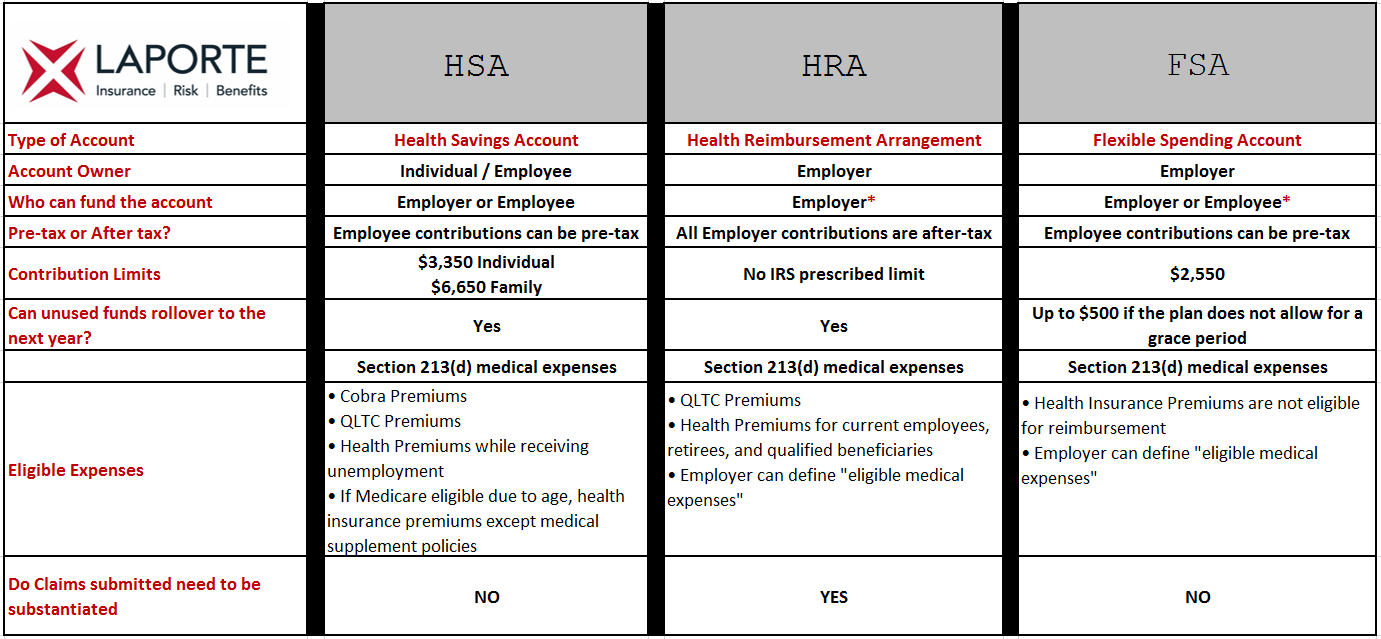

Employers are increasingly looking to consumer-driven health plans to health plans to help soften the blow of continually rising health care costs. Depending on the model, these plans typically include Health Reimbursement Arrangements (HRA’s), Flexible Spending Accounts (FSA’s), and Health Savings Accounts (HSA’s) . Some plans allow employees to use these accounts to pay for medical expenses that are not covered by insurance, while employers use others to provide employees with a fixed dollar amount with which they can purchase health care services or a health insurance policy on the open market. This chart provides some basic information about the similarities and differences between each of these tax-advantaged accounts.